By Richard Thomas

News that Japanese drinks company Suntory bought Beam Global in a $16 billion deal was met with a decidedly mixed response in the United States, both in the press and among whiskey fans. Some mourned the end of the “Beam family business,” while others fretted that Japanese ownership of Beam would somehow mean a loss of identity for a bourbon brand that predates the U.S. Constitution.

Such worries and murmurs are largely groundless, and in some cases come tinged with more than a little jingoism. What is more, far from being a bad thing, Beam’s acquisition by Suntory might prove to have benefits for whiskey drinkers in the United States and around the world.

The Family Business?

The single most ironic part of the mixed public response to the Suntory purchase of Beam is that it was somehow the end of an era, bringing about an end to “Beam’s family business.” The first thing wrong with that idea is that Beam Global wasn’t actually owned by Beam-Noe clan, although the brand itself has been under the stewardship of the family since its foundations.

Beam Global was the product of a break-up of the American Brands holding company in 2011. The relationship between Jim Beam Distillery, the Beam-Noe clan, and the parent company bearing its name is akin to that of the Samuels family, Maker’s Mark, and none other than Beam Global itself: Beam owns Maker’s Mark, although the Samuels family still runs it.

What makes this misconception about who really owns and runs Beam Global, as opposed to Jim Beam Distillery, ironic is that Beam’s new owner, Suntory, really is a private, family-owned company. In other words, Suntory is the very thing so many people wrongly thought Beam Global was.

Yellow Peril?

Another faulty notion is that somehow a Japanese company must necessary fumble the ball when it comes to bourbon-making, a notion that in and of itself expresses ignorance of the true state of affairs in the bourbon industry. Kirin, the Japanese brewery company, bought Four Roses in 2002, a move that ultimately helped carry the long neglected bourbon brand to new heights. Before then, Four Roses was only a rotgut blended whiskey in the United States, with the straight bourbon limited to export. The premium expressions that are so popular today didn’t even exist prior to the takeover by Kirin.

Over in Japan, Suntory is almost synonymous with whiskey. The company’s founder, Torii Shinjiro, was the man who built the Yamazaki Distillery in the 1920s. In addition to their foundational presence in Japanese whiskey, which has enjoyed growing popularity around the world in recent years, Suntory also owns Bowmore and Auchentoshan over in Scotland. Finally, it has to be said that the Japanese love bourbon, as any Kentuckian whose memory stretches back to the 1980s knows perfectly well. Suntory hardly looks like the outfit to make a mess of Beam.

Wait, Weren’t You Cursing Beam The Other Day?

Those with long memories and a wide perspective might find it strange that anyone is upset at the idea of an outside company taking control of Beam Global. After all, Beam has been a particularly acquisitive company (or division of a larger company) itself in recent years, and that focus on buying up other whiskey companies has in many cases led to choices that angered whiskey drinkers from the Irish Sea to the Pacific Ocean.

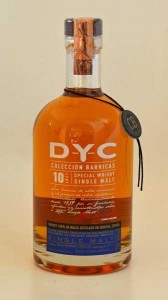

For starters, Beam’s drive to expand likely contributed to last year’s Maker’s Mark watering down scandal. In 2005, Maker’s Mark was set to start a far-sighted expansion program, intended to increase their production capacity by 50%. When Fortune Brands (as American Brands, Beam’s owners, were called back then) bought Maker’s Mark, those plans were shelved. American Brands and then it’s Beam Global successor would go on to spend a dump truck of capital on acquiring new companies, such as DYC and Cooley, while the much-needed expansion of Maker’s Mark went neglected, until finally demand well and truly overtook supply.

Likewise, Beam’s 2012 purchase of Cooley led to the parent company shutting down many long-standing arrangements between Ireland’s then-sole independent distillery and the many small brands that relied on it to source their whiskey. American Irish whiskey brand Michael Collins actually took Beam to court over breach of contract, while uncertainty and non-renewal announcements have pushed many small, sourced brands in Ireland to turn to starting their own micro-distilleries.

It’s Globalization, So Relax

My bet is that the Beam buy-out’s results will be largely positive, because at the very least it will probably mean wider availability for Suntory’s Japanese whiskey in the United States. After all, with the population of Japan shrinking, expansion into foreign markets is key to the survival of Japanese distillers. In time, high quality Japanese whiskeys might become a major alternative in the United States for pricey, aged, and increasingly hard to get Scotch whiskeys.

Furthermore, it’s not like Suntory would commit brand suicide by taking Jim Beam away from the Beam-Noe clan, or Maker’s Mark away from the Samuels family. Let’s also not forget the Japanese seem to love Kentucky bourbon just the way it is. Finally, if that isn’t enough to calm nervous fears about globalization and foreign ownership of your down-home whiskey, even though it is still made in the same down-home way and down-home place, keep in mind that Sazerac and Brown-Forman are still American-owned and in the whiskey trade, and that any further big, foreign buy-outs in the whiskey business are most unlikely for the foreseeable future.

The Whiskey Reviewer A World of Whiskey, Poured Every Weekday

The Whiskey Reviewer A World of Whiskey, Poured Every Weekday

Good point. Jim Beam is a family-run business, but Beam Global is just another faceless corporation. The name “Beam” obscured that difference.