A subject that often arises in conversations with enthusiasts, colleagues, industry professionals and bar folks is the end of the world whiskey boomtimes. Changing tastes tend to be a generational matter, and that would point to a 1970s crash coming only when not just the Zoomers, but the generation following them become the primary drinks consumers in the U.S. The other possibility would be poor business decisions, and with that in mind The Whiskey Reviewer is starting this periodic series on past examples of the giants of world whisky bring brought low through their own doings.

By Richard Thomas

As cautionary tails go, the story of how the Pattison Brothers rose from modest beginnings to the barons of the Scotch whisky industry, only to lead that industry into a speculative collapse is instructive not just to liquor-makers since, but to anyone in business and enjoying explosive growth.

Scotch whisky had been on the rising to supplant Irish whiskey since the early-to-mid 19th Century. Although it’s a myth that the Irish whiskey industry rejected the Coffey Still, an Irish invention, they didn’t adopt it or apply it with the same enthusiasm and success as the Scots. Cheaper and lighter grain whiskies led to the creation of brands like Dewar’s and Johnnie Walker, and spearheaded by enterprising salesmen and marketeers, such as brothers John and Thomas Dewar (as we mythologize distillers, it’s often overlooked how most of the key figures in world whiskey history were on the business, not the production side) these whiskies were sold around the world.

Pattison, Ltd. recognized a good thing when they saw it, and as many of the original blended whiskies were created by grocery firms, followed them into the trade in 1887. It was at this same time that the Great Phylloxera Epidemic devastated French viticulture, which would cause wine output to plunge by three-quarters between 1875 and 1889. Robert and Walter Pattison weren’t the only ones to see the opportunity the fall of French wine had opened up, but they were arguably the most skilled at exploiting it.

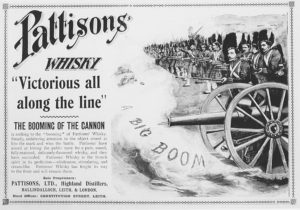

They took Pattison, Ltd. public in 1889, opening the door to financing rapid expansion of both stock and sales. In an era when advertising as we know it today was in its infancy, they spent vast sums on ads and gimmicks. The best known of the latter were the 500 grey parrots they had trained to say things like “Buy Royal Gordon” (a Pattison whisky brand), which were given out to publicans across Britain.

They were also early masters of the art of convincing the world they were a success through conspicuous consumption. The soon acquired palatial country retreats (which were used as a stage for publicity, of course), well-appointed townhouses in Edinburgh and regal offices in Leith. The brothers also made a habit of missing their trains and resorting to hiring private trains at exorbitant expense, but only after notifying the press first.

It was this extravagant promotion-by-luxury lifestyle that probably led to their downfall. Using the kind of accounting gimmicks that appear in great speculative downfalls such as Enron and stock buyback tactics (in this case, the stock was whisky, not paper), Pattison, Ltd. was able to artificially inflate the value of their holdings and support their financing. It was a model that could only work in the short term and only in boom times.

In 1898, Robert and William could no longer keep all their balls in the air. They stiffed several suppliers, defaulted on debts and were caught blending a lot of cheap grain whisky with a small proportion of aged malt whisky and calling it “Fine Old Glenlivet.” The collapse of the firm was inevitable, as they were operating almost like a Ponzi scheme: paying investors out of their capital reserves, which in turn were plumped up by new investment. The firm was in bankruptcy proceedings by early December.

Those proceedings revealed some half a million pounds were missing from the company’s coffers (a sum worth £62 million today), while the company’s assets were (finally) properly assessed at less than half that. The pair were tried for embezzlement and fraud, and convicted after a mere hour and a half of jury deliberations. Robert was sentenced to 18 months in prison, and William to 9 months.

The fall of Pattison, Ltd. swamped the Scotch whisky industry as a whole. Many suppliers doing business with the Pattisons were left holding the bag on unpaid bills and went out of business. Whisky prices fell and credit dried up, causing the distillery building boom of the late 19th Century to stop entirely. Scotland would not see a new distillery built until 1949.

The Whiskey Reviewer A World of Whiskey, Poured Every Weekday

The Whiskey Reviewer A World of Whiskey, Poured Every Weekday